NOMINEES FOR ELECTION TO THE BOARD

Each of the proposed director nominees

iswill be an incumbent director. Each director nominee elected at the

20212023 Annual Meeting will hold office until the close of the

20222024 Annual Meeting of Shareholders, his or her successor is duly elected or appointed, or such director’s earlier resignation or removal.

The results from the

20202022 election of directors are as follows:

| | | | | | | | | | | | |

Name | | For | | | Withheld | | | Broker Non-Votes | |

Richard U. De Schutter | | | 216,315,704 | | | | 5,259,134 | | | | 59,178,282 | |

D. Robert Hale | | | 211,714,041 | | | | 9,860,797 | | | | 59,178,282 | |

Dr. Argeris (Jerry) N. Karabelas | | | 215,596,446 | | | | 5,978,392 | | | | 59,178,282 | |

Sarah B. Kavanagh | | | 217,011,297 | | | | 4,563,541 | | | | 59,178,282 | |

Joseph C. Papa | | | 212,494,697 | | | | 9,080,141 | | | | 59,178,282 | |

John A. Paulson | | | 219,853,068 | | | | 1,721,770 | | | | 59,178,282 | |

Robert N. Power | | | 208,740,697 | | | | 12,834,141 | | | | 59,178,282 | |

Russel C. Robertson | | | 215,372,886 | | | | 6,201,952 | | | | 59,178,282 | |

Thomas W. Ross, Sr. | | | 215,468,972 | | | | 6,105,866 | | | | 59,178,282 | |

Andrew C. von Eschenbach, M.D. | | | 219,493,913 | | | | 2,080,925 | | | | 59,178,282 | |

Amy B. Wechsler, M.D. | | | 216,271,318 | | | | 5,303,520 | | | | 59,178,282 | |

Thomas J. Appio | | | 208,484,011 | | | 4,473,053 | | | 70,926,205 |

Richard U. De Schutter(1) | | | 204,019,165 | | | 8,937,899 | | | 70,926,205 |

Brett M. Icahn | | | 202,357,292 | | | 10,599,772 | | | 70,926,205 |

Dr. Argeris N. Karabelas(1) | | | 201,356,292 | | | 11,600,478 | | | 70,926,205 |

Sarah B. Kavanagh | | | 204,141,525 | | | 8,815,539 | | | 70,926,205 |

Steven D. Miller | | | 203,021,418 | | | 9,935,646 | | | 70,926,205 |

Dr. Richard C. Mulligan | | | 195,477,842 | | | 17,479,222 | | | 70,926,205 |

Joseph C. Papa(2) | | | 176,759,880 | | | 36,197,184 | | | 70,926,205 |

Robert N. Power | | | 153,014,215 | | | 59,942,849 | | | 70,926,205 |

Russel C. Robertson | | | 199,201,436 | | | 13,755,628 | | | 70,926,205 |

Thomas W. Ross, Sr. | | | 199,710,479 | | | 13,246,585 | | | 70,926,205 |

Amy B. Wechsler, M.D. | | | 204,605,343 | | | 8,351,721 | | | 70,926,205 |

(1)

| On February 28, 2023, Mr. De Schutter and Dr. Karabelas notified the Company of their decision to retire from the Board, effective at the 2023 Annual Meeting. The retirement of each of Mr. De Schutter and Dr. Karabelas was not the result of any dispute or disagreement with the Company or the Board on any matter relating to the operations, policies or practices of the Company. |

(2)

| On June 23, 2022, Mr. Papa resigned from the Board. Mr. Papa's decision to resign from the Board was not due to any dispute or disagreement with the Company, its management or the Board on any matter relating to the Company's operations, policies, or practices. The Board appointed Mr. Paulson to rejoin the Board to fill the resulting vacancy and to serve as the Non-Executive Chairperson of the Board, effective upon Mr. Papa's resignation. |

The following narratives provide details about each of the director nominees’ background and experience, and summarizes the specific attributes, competencies and characteristics that led to the determination of the Nominating and Corporate Governance Committee and the Board to nominate such individual as a director for election by the shareholders at the

Annual Meeting. In addition, the narrative lists the number of meetings of the Board and any applicable committee each director nominee attended during

20202022 and any public company directorships, other than with the Company, held by the nominees during the past five years. The narrative also sets out (i) the number of securities of the Company each director nominee beneficially owned, controlled or directed, directly or indirectly, as of March

1, 2021;17, 2023; (ii) the aggregate value of such securities based on the

$31.75$ per share closing price of our Common Shares on March

1, 2021,17, 2023, as reported on the NYSE; and (iii) the progress of each director nominee toward the director share ownership requirement established by the Board. For further detail regarding the share ownership requirement for

non-employee Directors, see the discussion in the section titled “Statement of Corporate Governance Practices — Directors’ Share Ownership” on page

31.26. For further detail regarding the share ownership requirement for Mr.

Papa,Appio, see the discussion in the section titled “Compensation Discussion and Analysis — Other Compensation Governance Practices — Share Ownership Guidelines” on page

64.56.

Mr. De Schutter has served on the Board since January 2017. Mr. De Schutter is the owner of asset management firm L.B. Gemini, Inc., where he has served as President and director since 2000. He previously served as the Chairman and CEO of DuPont Pharmaceuticals Company from July 2000 until its acquisition by Bristol-Myers Squibb in October 2001. Mr. De Schutter was also a director and Chief Administrative Officer of Pharmacia Corporation, which was created through the merger of Monsanto Company and Pharmacia & Upjohn in 2000. Prior to this merger, Mr. De Schutter was a director, Vice Chairman and Chief Administrative Officer for Monsanto. From 1995 to 1999, he served as Chairman and CEO of G.D. Searle & Co., Monsanto’s wholly owned pharmaceutical subsidiary. Mr. De Schutter earned a Bachelor of Science degree in 1963, and a Master of Science Degree in Chemical Engineering in 1965 from the University of Arizona.

Mr. De Schutter has served as a director of AuVen Therapeutics, a private equity company focused on the healthcare industry, since 2007, and as a director of Sermonix Pharmaceuticals Inc., a private biotechnology company, since April 2019. He previously served as Chairman of publicly traded pharmaceutical companies Incyte Corporation, from 2003 to 2015, and Durata Therapeutics, Inc., from 2012 to 2014. Mr. De Schutter also served as a director of Smith & Nephew plc, a publicly traded medical device company, from 2001 to 2014, during which time he also served as the Lead Independent Director from 2011 to 2014.

Director Qualifications:

The Board has determined that Mr. De Schutter’s many years of experience in senior management and board positions of publicly traded companies, as well as his extensive insight and knowledge of the pharmaceutical industry and healthcare-related issues qualify him to serve as a member of the Board and the committees on which he serves.

12

Mr. Richard U. De Schutter

Arizona, USA

Age 80

Independent

Stock Ownership:

TABLE OF CONTENTS

273,620 Common Shares — $8,687,435

37,402 Restricted Share Units (“RSUs”) (comprised of 26,365 vested RSUs — $837,089, and 11,037 unvested RSUs — $350,425)

Age: 61

New Jersey, USA

Director Since: 2022

Non-Independent

Committees:

• Science & Technology Committee | • | | Mr. Appio has been the Chief Executive Officer of the Company since May 2022. He previously served as the Company’s President & Co-Head Bausch + Lomb/ International and Executive Vice President, Company Group Chairman, International. Prior to joining Bausch Health in 2013, Mr. Appio served in several positions with Bausch + Lomb, including as Vice President, North Asia/Japan and as Managing Director, Greater China and Japan. Prior to joining Bausch + Lomb, Mr. Appio served 23 years with Schering-Plough in a wide range of leadership and operations responsibilities. Mr. Appio holds a Bachelor of Science in Accounting from Arizona State University, W.P. Carey School of Business.

| | | Stock Ownership:

• 194,862 Common Shares — $1,480,051

• 695,999 RSUs (comprised of 695,999 unvested RSUs — $5,289,592)

• 482,201 Stock Options

• Total Equity Value at RiskRisk: $1,480,051 based on the value of the Common Shares beneficially owned by Mr. Appio (but excluding all options and unvested RSUs).

Mr. Appio is subject to share ownership guidelines under the terms of his employment agreement with the Company, as further described in the section titled “Compensation Discussion and Analysis — Other Compensation Governance Practices – Share Ownership Guidelines” on page 56.

2022 Meeting Attendance:1: $9,524,524,

• Board: 9/9

Qualifications:

The Board has determined that Mr. Appio’s extensive management experience and demonstrated leadership with the Company is a valuable contribution to the Board. |

TABLE OF CONTENTS

Age: 43

Florida, USA

Director Since: 2021

Independent

Committees:

• Nominating & Corporate Governance (Chair)

• Finance & Transactions Committee | | | Mr. Icahn was appointed to the Board on March 17, 2021 pursuant to the Nomination Agreement described under “Certain Transactions” beginning on page 80. Since October 2020, he has been a portfolio manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion. Mr. Icahn has held a variety of investment advisory roles at Icahn Enterprises L.P. since 2002, including as an investment strategy consultant from 2017 to October 2020, and as portfolio manager of the Sargon Portfolio from 2010 to 2017.

Mr. Icahn joined the board of directors of Bausch + Lomb Corporation, a publicly traded eye health company, in May 2022, and has served on the board of Icahn Enterprises L.P., a private entity since October 2020. He has also been a director of Dana Inc., a supplier of automotive products and services, since January 2022. Mr. Icahn was previously a director of Nuance Communications, Inc., a provider of voice and language solutions, from October 2013 to March 2016, and Newell Brands Inc., a publicly traded global marketer of consumer and commercial products, since March 2018 to March 2023. Mr. Icahn also previously served on the boards of American Railcar Industries, Inc., Take-Two Interactive Software Inc., The Hain Celestial Group, Inc. and Voltari Corporation. Mr. Carl C. Icahn, the founder and controlling shareholder of Icahn Enterprises L.P., has or previously had non-controlling interests in Nuance Communications, Inc., Hain Celestial Group, Inc. and Take-Two Interactive Software Inc. Mr. Icahn received a B.A. from Princeton University. | | | Stock Ownership:

• 8,389 Common Shares — $63,756

• 17,424 Restricted Share Units (“RSUs”) (comprised of 17,424 vested RSUs — $132,514, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $196,270 representing 1,905%39% of both the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 196% of the annual Board retainer. Mr. Icahn has until March 17, 2026 to achieve the expected minimum equity ownership under such share ownership guidelines.

2022 Meeting Attendance:

• Board: 13/13

• Finance & Transactions Commit tee: 13/13

• Special Transactions Committee: 2/2

Qualifications:

The Board has determined that Mr. Icahn’s experience at the Icahn entities, and his service as a director of multiple public company boards, and his tenure as a Portfolio Manager provide him with expertise in investing and capital allocation, which qualifies him to serve as a member of the Board and the committees on which he serves. |

TABLE OF CONTENTS

Age: 66

Ontario, Canada

Director Since: 2016

Independent

Committees:

• Audit & Risk Committee

• Finance & Transactions Committee | | | Ms. Kavanagh has served on the Board since July 2016. She is currently a corporate director. From 2011 through May 2016, Ms. Kavanagh served as a Commissioner of the Ontario Securities Commission, where she also served as chairperson of the audit committee starting in 2014. Between 1999 and 2010, Ms. Kavanagh served in various senior investment banking roles at Scotia Capital Inc., including Vice-Chair and Co-Head of Diversified Industries Group, Head of Equity Capital Markets, and Head of Investment Banking. Prior to Scotia Capital, she held several senior financial positions with operating companies. She started her career as an investment banker with a multinational bank in New York. Ms. Kavanagh graduated from Harvard Business School with a Master of Business Administration and received a Bachelor of Arts degree in Economics from Williams College.

Ms. Kavanagh joined the board of directors of Bausch + Lomb Corporation, a publicly traded eye health company, in May 2022. Since 2013, Ms. Kavanagh has been a director of Hudbay Minerals Inc., a publicly traded Canadian mining corporation Ms. Kavanagh previously served as a member of the board of trustees of WPT Industrial REIT, a publicly traded open-ended real estate investment trust, from 2013 to October 2021. In addition to her public company directorships, she is a director of AST and Cymax Technology Group and also serves as a director of Sustainable Development Technology Canada. She completed the Directors Education Program at the Institute of Corporate Directors in 2011. | | | Stock Ownership:

• 0 Common Shares — $0

• 117,447 Restricted Share Units (“RSUs”) (comprised of 83,060 vested RSUs — $631,256 and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $631,256, representing 126% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 9,525% 631% of the annual Board retainer.

2022 Meeting Attendance:

• Board: 13 /13

• Audit & Risk Committee: 8/8

• Nominating & Corporate Governance Committee: 6/6

• Finance & Transactions Committee: 13/13

• Special Transactions Committee: 2/2

Qualifications:

The Board has determined that Ms. Kavanagh’s extensive experience of complex financial and capital market issues at various banking institutions, and her in-depth knowledge of financial and operational matters qualify her to serve as a member of the Board and the committees on which she serves. |

2020 Meeting Attendance:

TABLE OF CONTENTS

Talent and Compensation Committee — 7/7

Finance and Transactions Committee — 7/7

Special Transactions Committee — 4/4

Age: 34

Florida, USA

Director Since: 2021

Independent

Committees:

• Audit & Risk Committee

• Finance & Transactions Committee (Chair) | | | Mr. Miller has served on the Board since March 2021 pursuant to the Nomination Agreement described under “Certain Transactions” beginning on page 80. Since October 2020, Mr. Miller has been a portfolio manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses. Prior to joining Icahn Capital L.P., Mr. Miller was an analyst in the Distressed and Special Situations investment group in the New York office of BlueMountain Capital Management, LLC from 2013 to 2019. Mr. Miller represented BlueMountain on the Ad Hoc Group of Puerto Rico Electric Power Authority Bondholders from 2014 to 2019, and from 2011 to 2013 he was an analyst in the Distressed Products Group in the New York office of Goldman, Sachs & Co. Mr. Miller received a B.S. summa cum laude from Duke University in 2011.

Mr. Miller has served as a director of Conduent Incorporated, a publicly traded business process services company, since February 2021, and Xerox Holdings Corporation, a publicly traded office equipment company, since May 2021. Mr. Miller was previously a director of Herc Holdings Inc., a publicly traded equipment rental supplier, from May 2022 to March 2023 | | | Stock Ownership:

• 68,4891 | TheCommon Shares — $520,516

• 51,823 Restricted Share Units (“RSUs”) (comprised of 17,436 vested RSUs — $132,514, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk calculationRisk: $653,030 representing 131% of both the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for each directornon-employee Directors and 653% of the annual Board re tainer.

2022 Meeting Attendance:

• Board: 13/13

• Finance & Transactions Committee: 13/13

• Special Transactions Committee: 2/2

Director Qualifications:

The Board has determined that Mr. Miller’s experience as a portfolio manager and securities analyst has provided him with experience in investing and finance and complex debt matters, respectively, which qualifies him to serve as a member of the Board and the committees on which he serves. |

TABLE OF CONTENTS

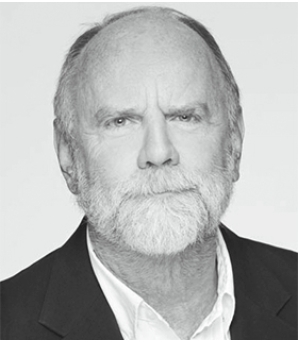

Age: 68

Massachusetts, USA

Director Since: 2022

Independent

Committees:

• Nominating & Corporate Governance

• Science & Technology Committee (Chair) | | | Dr. Mulligan has served on the Board since May 2022. Dr. Mulligan is currently the Mallinckrodt Professor of Genetics, Emeritus, at Harvard Medical School, after serving as the Mallinckrodt Professor of Genetics and Director of the Harvard Gene Therapy Initiative from 1996 to 2013. Dr. Mulligan also currently serves as Executive Vice Chairman of the Board of Sana Biotechnology, Inc. a public biotechnology company, and a director of Biogen Inc., a public biotechnology company. Prior to Harvard, Dr. Mulligan was a professor of Molecular Biology at the Massachusetts Institute of Technology, a member of the Whitehead Institute for Biomedical Research and chief scientific officer of Somatix Therapy Corporation, a drug discovery and development company that he founded. Dr. Mulligan was a founding partner of Sarissa Capital Management LP from 2013 to 2016 and from March 2017 to October 2018 served as Portfolio Manager at Icahn Capital LP. He was named a MacArthur Foundation Fellow in 1981. | | | Stock Ownership:

• 2,317 Common Shares — $17,609

• 34,387 Restricted Share Units (“RSUs”) (comprised of 0 vested RSUs — $0, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $17,609 representing 4% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 18% of the annual Board retainer. Dr. Mulligan has until May 10, 2027 to achieve the expected minimum equity ownership under such share ownership guidelines.

2022 Meeting Attendance:1

• Board: 9/9

• Science & Technology Committee: 2/2

Qualifications:

The Board has determined that Dr. Mulligan’s extensive experience in the biotechnology and life sciences industries and international reputation in academia qualifies him to serve as a member of the Board and the committees on which he serves. |

TABLE OF CONTENTS

Age: 67

New York, USA

Director Since: 20171

Independent

Chairperson of the Board | | | Mr. Paulson rejoined the Board as our Non-Executive Chairperson on June 23, 2022, after resigning, as previously announced, on the IPO Closing Date. Mr. Paulson previously served on the Board from June 2017 through May 2022. Mr. Paulson is the President and Portfolio Manager of Paulson & Co. Inc., an investment management company specializing in global mergers, event arbitrage and credit strategies, which he founded in 1994. Prior to forming Paulson & Co. Inc., Mr. Paulson was a Partner of Gruss Partners and a Managing Director in mergers and acquisitions at Bear Stearns. Mr. Paulson received his undergraduate degree from New York University in 1978 and his Master of Business Administration from Harvard Business School in 1980.

Mr. Paulson joined the board of directors of Bausch + Lomb Corporation, a publicly traded eye health company, in May 2022. Mr. Paulson has been a director of BrightSphere Investment Group Inc., a publicly traded asset management holding company, since November 2018, and has served as Chairman since April 2020. Mr. Paulson previously served as a member of the advisory board of Harvard Business School, from June 2008 to June 2022, and as a director of American International Group Inc., a multinational finance and insurance corporation, from May 2016 to June 2017. | | | Stock Ownership:

• 26,439,035 Common Shares — $200,936,666

• 142,290 RSUs (comprised of 107,903 vested RSUs — $820,063, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $201,756,729, representing 40,351% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 201,757% of the annual Board retainer.

2022 Meeting Attendance:1

• Board: 11/11

• Finance & Transactions Committee: 2/2

• Special Transactions Committee: 2/2

Qualifications:

The Board has determined that the skills and expertise that Mr. Paulson acquired founding and leading Paulson & Co. Inc., including his in-depth knowledge of financial transactions and leadership abilities, qualify him to serve as a member of the Board and the committee on which he serves. |

TABLE OF CONTENTS

Age: 66

Pennsylvania, USA

Director Since: 2008

Independent

Committees:

• Talent & Compensation Committee (Chair)

• Nominating & Corporate Governance | | | Mr. Power has served on the Board since August 2008. He is currently a corporate director. From 2009 to 2011, Mr. Power was a faculty member at The Wharton School of Business, University of Pennsylvania, where he taught multinational marketing. Mr. Power has over 25 years’ experience working in the pharmaceutical and biotechnology industry, which he gained serving in a number of leadership positions with Wyeth from 1985 through 2007, including Director — New Product Development, Managing Director — U.K./Ireland, Vice President — Global Marketing, President — Europe, Middle East, Africa, President — International and Executive Vice President — Global Business Operations. Mr. Power also has completed the Director Professionalism course offered by the relevant director. It does not includeNational Association of Corporate Directors. Mr. Power has a B.S. in statistics from the valueState University of any options (as applicable) orNew York and an M.S. in biostatistics from the Medical College of Virginia- Virginia Commonwealth University. | | | Stock Ownership:

• 6,601 Common Shares — $50,168

• 129,210 Restricted Share Units (“RSUs”) (comprised of 94,823 vested RSUs — $720,655, and 34,387 unvested RSUs.RSUs — $261,341)

• Total Equity Value at Risk: $770,822, representing 154% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 771% of the annual Board retainer.

2022 Meeting Attendance:1

• Board: 13/13

• Audit & Risk Committee: 8/8

• Nominating & Corporate Governance Committee: 6/6

• Talent & Compensation Committee: 4/4

• Science & Technology Committee: 1/1

Qualifications:

The Board has determined that Mr. Power’s extensive experience in the pharmaceutical industry and international business is a valuable contribution to the Board. In addition, his experience in general management, strategic planning, working with Research and Development organizations, business development, product marketing, merging and streamlining of organizations and his demonstrated leadership in a multi-billion-dollar business qualify Mr. Power as a member of the Board and the committees on which he serves. |

Mr. Hale has served on the Board since August 2015. He is a Partner of ValueAct Capital Management, L.P. (“ValueAct Capital”), a governance-oriented investment fund which invests in a concentrated portfolio of public companies and works collaboratively with management and the board of directors on matters such as strategy, capital structure, M&A and talent management. During his tenure at ValueAct Capital as a Partner, and formerly as a Vice President and Associate, Mr. Hale has worked on investments in the pharmaceutical, medical device, information technology and business services industries. Prior to joining ValueAct Capital in January 2011, Mr. Hale was a Principal with The Parthenon Group, a strategy consultancy firm, working with corporate and private equity clients in industries such as investment management, media, education and retail in both the Boston and Mumbai offices of Parthenon’s strategic consulting practice. He also worked in an investment role at Parthenon’s long-short public equity vehicle, Strategic Value Capital. Mr. Hale has an A.B. from Dartmouth College.

Mr. Hale has served as a director of Olympus Corporation, a publicly traded manufacturer of optics and reprography products, since June 2019.

Director Qualifications:

The Board has determined that Mr. Hale’s in-depth knowledge of complex financial and global capital market issues, his proven leadership experience in investment and governance positions, and his extensive knowledge of financial and operational matters qualify him to serve as a member of the Board and the committees on which he serves.

Mr. D. Robert Hale

California, USA

Age 36

Independent

Stock Ownership:

17,941,603 Common Shares — $569,645,895

11,037 RSUs (comprised of 0 vested RSUs — $0, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $569,645,895, representing 113,929% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 569,646% of the annual Board retainer.

2020 Meeting Attendance:

Talent and Compensation Committee — 7/7

Finance and Transactions Committee — 7/7

Special Transactions Committee — 4/4

Mr. Icahn was appointed to the Board on March 17, 2021 pursuant to the Appointment and Nomination Agreement described under “Certain Transactions” begining on page 90 (the “Nomination Agreement”). Since October 2020, he has been a portfolio manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion. Mr. Icahn has held a variety of investment advisory roles at Icahn Enterprises L.P. since 2002, including as an investment strategy consultant from 2017 to October 2020, and as portfolio manager of the Sargon Portfolio from 2010 to 2017.

Mr. Icahn has served on the board of Icahn Enterprises L.P., a private entity, since October 2020. He has also been a director of Newell Brands Inc., a publicly traded global marketer of consumer and commercial products, since March 2018, and was previously a director of Nuance Communications, Inc., a provider of voice and language solutions, from October 2013 to March 2016. Mr. Icahn also previously served on the boards of American Railcar Industries, Inc., Take-Two Interactive Software Inc., The Hain Celestial Group, Inc. and Voltari Corporation. Mr. Carl C. Icahn, the founder and controlling shareholder of Icahn Enterprises L.P., has or previously had non-controlling interests in Nuance Communications, Inc., Hain Celestial Group, Inc. and Take-Two Interactive Software Inc. Mr. Icahn received a B.A. from Princeton University.

Director Qualifications:

The Board has determined that Mr. Icahn’s experience at the Icahn entities, and his service as a director of multiple public company boards, and his tenure as a Portfolio Manager provide him with expertise in investing and capital allocation, which qualifies him to serve as a member of the Board and the committees on which he serves.

Brett Icahn

Florida, USA

Age 41

Independent

Stock Ownership:

Total Equity Value at Risk: $0 representing 0% of both the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and the annual Board retainer. Mr. Icahn has until March 17, 2026 to achieve the expected minimum equity ownership under such share ownership guidelines.

2020 Meeting Attendance:

Not applicable.

1

| On the IPO Closing Date, Mr. Power was appointed to the Talent and Compensation Committee and resigned from the Science and Technology Committee. |

Dr. Karabelas has served on the Board since June 2016. Since January 2021, he has been a Venture Partner at Apple Tree Partners, a life sciences venture firm. From December 2001 until December 2020, he was a Partner at Care Capital, LLC, a life sciences venture firm. Dr. Karabelas was previously the founder and Chairman at Novartis BioVenture Fund, and served as Head of Healthcare and CEO of Worldwide Pharmaceuticals for Novartis Pharma AG. Prior to joining Novartis, Dr. Karabelas was Executive Vice President of SmithKline Beecham, where he was responsible for U.S. and European operations, regulatory and strategic marketing. Dr. Karabelas received a B.S. from the University of New Hampshire and a Ph.D. from the Massachusetts College of Pharmacy.

Dr. Karabelas has been a director of REGENXBIO Inc., a publicly held clinical-stage biotechnology company, since May 2015, and since July 2020 has also served as Lead Independent Director. He has also served on the board of Braeburn Pharmaceuticals, Inc., a privately held specialty pharmaceuticals company, since September 2015. Dr. Karabelas previously served as Chairman of the board of Inotek Pharmaceuticals Corporation, a clinical-stage biopharmaceutical company (which merged with Rocket Pharmaceuticals, Inc. in 2017), from July 2012 until June 2016.

Director Qualifications:

The Board has determined that Dr. Karabelas’s many years of experience in senior management positions, his strong knowledge of strategic and regulatory issues, his insight into international operations and his international perspective on the pharmaceutical industry and healthcare related issues qualify him to serve as a member of the Board and the committees on which he serves.

Dr. Argeris (Jerry) N. Karabelas

New Hampshire, USA

Age 68

Independent

Stock Ownership:

4,000 Common Shares — $127,000

77,683 RSUs (comprised of 66,646 vested RSUs — $2,116,011, and 11,037 unvested RSUs —$350,425)

Total Equity Value at Risk: $2,243,011, representing 449% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 2,243% of the annual Board retainer.

2020 Meeting Attendance:

Talent and Compensation Committee — 7/7

Science and Technology Committee — 6/6

Special Transactions Committee — 4/4

Ms. Kavanagh has served on the Board since July 2016. She is currently a corporate director. From 2011 through May 2016, Ms. Kavanagh served as a Commissioner of the Ontario Securities Commission, where she also served as chairperson of the audit committee starting in 2014. Between 1999 and 2010, Ms. Kavanagh served in various senior investment banking roles at Scotia Capital Inc., including Vice-Chair and Co-Head of Diversified Industries Group, Head of Equity Capital Markets, and Head of Investment Banking. Prior to Scotia Capital, she held several senior financial positions with operating companies. She started her career as an investment banker with a bulge bracket firm in New York. Ms. Kavanagh graduated from Harvard Business School with a Master of Business Administration and received a Bachelor of Arts degree in Economics from Williams College.

Since 2013, Ms. Kavanagh has been a director of Hudbay Minerals Inc., a publicly traded Canadian mining corporation, and a member of the board of trustees of WPT Industrial REIT, a publicly traded open-ended real estate investment trust. In addition to her public company directorships, she is a director of AST and AST Trust Company (Canada) (formerly Canadian Stock Transfer Company) and also serves as a director of Sustainable Development Technology Canada. She completed the Directors Education Program at the Institute of Corporate Directors in 2011.

Director Qualifications:

The Board has determined that Ms. Kavanagh’s extensive experience of complex financial and capital market issues at various banking institutions, and her in-depth knowledge of financial and operational matters qualify her to serve as a member of the Board and the committees on which she serves.

Sarah B. Kavanagh

Ontario, Canada

Age 64

Independent

Stock Ownership:

75,415 RSUs (comprised of 64,378 vested RSUs — $2,044,002, and 11,037 unvested RSUs —$350,425)

Total Equity Value at Risk: $2,044,002, representing 409% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 2,044% of the annual Board retainer.

2020 Meeting Attendance:

Audit and Risk Committee — 9/9

Nominating and Corporate Governance Committee — 4/4

Finance and Transactions Committee — 7/7

Special Transactions Committee — 4/4

TABLE OF CONTENTS

Age: 75

Ontario, Canada

Director Since: 2016

Independent

Committees:

• Audit & Risk Committee (Chair) | | | Mr. Robertson has served on the Board since June 2016. He is currently a corporate director. From 2013 through August 2016, Mr. Robertson served as EVP and Head, Anti-Money Laundering, at BMO Financial Group (“BMO”), a diversified financial services organization. Prior to that role, he served as EVP, Business Integration, at BMO Financial Group, and as Vice Chair at BMO Financial Corp. from 2011. He joined BMO as interim Chief Financial Officer, BMO Financial Group in 2008 and was appointed Chief Financial Officer, BMO Financial Group in 2009. Before joining BMO, Mr. Robertson spent over 35 years as a Chartered Public Accountant. In this capacity, he held various senior positions with a number of major accounting firms, including Vice Chair, Deloitte & Touche LLP in Toronto, Canada, from 2002 to 2008, and Canadian Managing Partner, Arthur Andersen LLP, from 1994 to 2002. Mr. Robertson holds a Bachelor of Arts degree (Honours) from the Ivey School of Business at the University of Western Ontario.

Mr. Robertson joined the board of directors of Bausch + Lomb Corporation, a publicly traded eye health company, in May 2022. Mr. Robertson has served on the board of Hydro One Limited, a publicly traded electricity transmission and distribution utility serving the Canadian province of Ontario, since August 2018. Mr. Robertson previously served on the board of Turquoise Hill Resources, a publicly traded Canadian mineral exploration and development company, from 2012 to December 2022, and Virtus Investment Partners, Inc., a multi-manager asset management business, from 2013 to August 2016. | | | Stock Ownership:

• 0 Common Shares — $0

• 177,416 Restricted Share Units (“RSUs”) (comprised of 143,029 vested RSUs — $1,087,020, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $1,087,020, representing 217% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 1087% of the annual Board re tainer.

2022 Meeting Attendance:

• Board: 13/13

• Audit & Risk Committee: 8/8

• Nominating & Corporate Gover nance Committee: 6/6

Qualifications:

The Board has determined that Mr. Robertson’s extensive experience of complex financial matters at Deloitte & Touche LLP and Arthur Andersen LLP, in-depth knowledge of financial and accounting matters and leadership capabilities in senior finance positions qualify him to serve as a member of the Board and as Chairman of the Audit and Risk Committee. |

Mr. Miller was appointed to the Board on March 17, 2021 pursuant to the Nomination Agreement described under “Certain Transactions” beginning on page 90. Since October 2020, Mr. Miller has been a portfolio manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion. Prior to joining Icahn Capital L.P., Mr. Miller was an analyst in the Distressed and Special Situations investment group in the New York office of BlueMountain Capital Management, LLC from 2013 to 2019. Mr. Miller represented BlueMountain on the Ad Hoc Group of Puerto Rico Electric Power Authority Bondholders from 2014 to 2019, and from 2011 to 2013 he was an analyst in the Distressed Products Group in the New York office of Goldman, Sachs & Co. Mr. Miller received a B.S. summa cum laude from Duke University in 2011.

Mr. Miller has been a director of Conduent Incorporated, a publicly traded business process services company, since February 2021.

Director Qualifications:

The Board has determined that Mr. Miller’s experience as a portfolio manager and securities analyst has provided him with experience in investing and finance and complex debt matters, respectively, which qualifies him to serve as a member of the Board and the committees on which he serves.

20

Steven D. Miller

Florida, USA

Age 32

Independent

Stock Ownership:

100 Common Shares — $3,175

Total Equity Value at Risk: $3,175 representing 1% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 3% of the annual Board retainer. Mr. Miller has until March 17, 2026 to achieve the expected minimum equity ownership under such share ownership guidelines.

2020 Meeting Attendance:

Mr. Papa has been Chairman of the Board and Chief Executive Officer of the Company since May 2016. Mr. Papa has more than 35 years of experience in the pharmaceutical, healthcare and specialty pharmaceutical industries, including 20 years of branded prescription drug experience. He served as the CEO of Perrigo Company plc (“Perrigo”) from 2006 to April 2016, where he also served as Chairman from 2007 to April 2016. Prior to joining Perrigo, Mr. Papa served from 2004 to 2006 as Chairman and CEO of the Pharmaceutical and Technologies Services segment of Cardinal Health, Inc. From 2001 to 2004, he served as President and Chief Operating Officer of Watson Pharmaceuticals, Inc. (“Watson”). Prior to joining Watson, Mr. Papa held management positions at DuPont Pharmaceuticals, Pharmacia/Searle and Novartis AG. Mr. Papa holds a BS in pharmacy from the University of Connecticut and an MBA from Northwestern University’s Kellogg Graduate School of Management.

Mr. Papa joined the board of directors of Prometheus Biosciences, Inc., a privately held biopharmaceutical company, in August 2020, and previously served as a director of Smith & Nephew plc, a publicly traded medical device company, from 2008 to April 2018.

Director Qualifications:

The Board has determined that Mr. Papa’s extensive experience as a chief executive officer of a public company, where he demonstrated leadership capability and extensive knowledge of complex financial and operational issues facing large organizations, and his understanding of operations and financial strategy in challenging environments, qualify him to serve as a member of the Board. Additionally, Mr. Papa’s knowledge of the pharmaceutical industry and business, combined with his drive for innovation and excellence, position him well to serve as the Chairman of the Board.

Joseph C. Papa

New Jersey, USA

Age 65

Not Independent

Stock Ownership:

618,535 Common Shares — $19,638,486

153,138 RSUs (comprised of 153,138 unvested RSUs —$4,862,132)

Total Equity Value at Risk: $19,638,486, based on the value of the Common Shares beneficially owned by Mr. Papa (but excluding all options and unvested RSUs).

Mr. Papa is subject to share ownership guidelines under the terms of his employment agreement with the Company, as further described in the section titled “Compensation Discussion and Analysis – Other Compensation Governance Practices – Share Ownership Guidelines” on page 64.

2020 Meeting Attendance:

TABLE OF CONTENTS

Age: 72

North Carolina, USA

Director Since: 2016

Independent

Committees:

• Talent & Compensation Committee | | | Mr. Ross has served on the Board since March 2016. He served as our Lead Independent Director from June 2016 through June 2022. Mr. Ross joined the board of directors of Bausch + Lomb Corporation, a publicly traded eye health company, in May 2022. He served as president of the Volcker Alliance from July 2016 until December 2021. He continues to serve as a Senior Advisor to the Volcker Alliance as well as a director on the Alliance board. He is President Emeritus of the University of North Carolina (“UNC”), having served as President from 2011 to January 2016. Mr. Ross was named the Sanford Distinguished Fellow in Public Policy at the Duke University Sanford School of Public Policy in 2016. Prior to becoming President of the UNC system, Mr. Ross served as President of Davidson College, Executive Director of the Z. Smith Reynolds Foundation, director of the North Carolina Administrative Office of the Courts, a Superior Court judge, chief of staff to U.S. Congressman Robin Britt, a member of the Greensboro, NC law firm Smith, Patterson, Follin, Curtis, James & Harkavy, and Assistant Professor of Public Law and Government at UNC Chapel Hill’s School of Government. Mr. Ross holds a B.A. in Political Science from Davidson College and a J.D. from University of North Carolina School of Law. | | | Stock Ownership:

• 11,500 Common Shares — $87,400

• 120,811 Restricted Share Units (“RSUs”) (comprised of 86,424 vested RSUs — $656,822, and 34,387 unvested RSUs — $261,341)

• Total Equity Value at Risk: $744,222, representing 149% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 744% of the annual Board retainer.

2022 Meeting Attendance:

• Board: 13/13

• Audit & Risk Committee: 8/8

• Nominating & Corporate Governance Committee: 6/6

• Special Transactions Committee: 2/2

Qualifications:

The Board has determined that Mr. Ross’s demonstrated leadership in senior management positions, extensive experience with corporate governance responsibilities and complex knowledge of legal, compliance and operational issues qualify him to serve as a member of the Board and the committees on which he serves. |

Mr. Paulson has served on the Board since June 2017. Mr. Paulson is the President and Portfolio Manager of Paulson & Co. Inc., an SEC-registered investment management company specializing in global mergers, event arbitrage and credit strategies, which he founded in 1994. Prior to forming Paulson & Co. Inc., Mr. Paulson was a Partner of Gruss Partners and a Managing Director in mergers and acquisitions at Bear Stearns. Mr. Paulson received his undergraduate degree from New York University in 1978 and his Master of Business Administration from Harvard Business School in 1980.

Mr. Paulson has been a director of BrightSphere Investment Group Inc., a publicly traded asset management holding company, since November 2018, and has served as Chairman since April 2020. He also currently serves as a member of the advisory board of Harvard Business School. Mr. Paulson previously served as a director of American International Group Inc., a multinational finance and insurance corporation, from May 2016 to June 2017.

Director Qualifications:

The Board has determined that the skills and expertise that Mr. Paulson acquired founding and leading Paulson & Co. Inc., including his in-depth knowledge of financial transactions and leadership abilities, qualify him to serve as a member of the Board and the committee on which he serves.

21

John A. Paulson

New York, USA

Age 65

Independent

Stock Ownership:

25,839,035 Common Shares — $820,389,361

73,440 RSUs (comprised of 62,403 vested RSUs — $1,981,295, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $822,370,656, representing 164,474% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 822,371% of the annual Board retainer.

2020 Meeting Attendance:

Finance and Transactions Committee — 7/7

Special Transactions Committee — 4/4

Mr. Power has served on the Board since August 2008. He is currently a corporate director. From 2009 to 2011, Mr. Power was a faculty member at The Wharton School of Business, University of Pennsylvania, where he taught multinational marketing. Mr. Power has over 25 years’ experience working in the pharmaceutical and biotechnology industry, which he gained serving in a number of leadership positions with Wyeth from 1985 through 2007, including Director — New Product Development, Managing Director — U.K./Ireland, Vice President — Global Marketing, President — Europe, Middle East, Africa, President — International and Executive Vice President — Global Business Operations. Mr. Power also has completed the Director Professionalism course offered by the National Association of Corporate Directors. Mr. Power has a B.S. in statistics from the State University of New York and an M.S. in biostatistics from the Medical College of Virginia- Virginia Commonwealth University.

Director Qualifications:

The Board has determined that Mr. Power’s extensive experience in the pharmaceutical industry and international business is a valuable contribution to the Board. In addition, his experience in general management, strategic planning, working with Research and Development organizations, business development, product marketing, merging and streamlining of organizations and his demonstrated leadership in a multi-billion-dollar business qualify Mr. Power as a member of the Board and the committees on which he serves.

Robert N. Power

Pennsylvania, USA

Age 64

Independent

Stock Ownership:

6,601 Common Shares — $209,582

87,178 RSUs (comprised of 76,141 vested RSUs — $2,417,477, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $2,627,059, representing 525% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 2,627% of the annual Board retainer.

2020 Meeting Attendance:

Audit and Risk Committee — 9/9

Nominating and Corporate Governance Committee — 4/4

Science and Technology Committee — 6/6

TABLE OF CONTENTS

Age: 53

New York, USA

Director Since: 2016

Independent

Committees:

• Talent & Compensation Committee

• Science & Technology Committee | | | Dr. Wechsler has served on the Board since June 2016. She has been a practicing dermatologist in New York City since 2005. Dr. Wechsler is the author of The Mind-Beauty Connection, published by Simon & Schuster in 2008. She is board certified in both dermatology and psychiatry and is also an Adjunct Clinical Professor in Psychiatry at the Weill Cornell Medical College. As an expert on skin health, Dr. Wechsler serves as an advisor for Chanel Skin Care and is also a certified trainer and well-known KOL Speaker, qualified to teach physicians and other medical professionals in the use of various dermatological products. Dr. Wechsler is an active member of several medical professional organizations, including the American Academy of Dermatology, the American Psychiatric Association, the American Academy of Child and Adolescent Psychiatry, the Independent Doctors of New York, The Physicians Scientific Society, and The Skin Cancer Foundation. Dr. Wechsler completed her residency in psychiatry and a fellowship in child and adolescent psychiatry at New York Presbyterian Hospital’s Payne Whitney Clinic, and completed a residency in dermatology at SUNY Downstate Medical Center. Dr. Wechsler is currently pursuing a Master of Business Administration at Columbia Business School. | | | Stock Ownership:

• 7,645 Common Shares —$58,102

• 136,654 Restricted Share Units (“RSUs”) (comprised of 94,622 vested RSUs — $719,127 and 34,387 unvested RSUs — $)

• Total Equity Value at Risk: $777,229, representing 155% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 777% of the annual Board retainer.

2022 Meeting Attendance:

• Board: 13/13

• Talent & Compensation Committee: 8/8

• Science & Technology Committee: 3/3

Qualifications:

The Board has determined that Dr. Wechsler’s many years of experience as a board-certified dermatologist and psychiatrist, her strong knowledge of medical products to assist patients with their medical needs and her insight into the medical field and pharmaceutical industry and healthcare related issues qualify her to serve as a member of the Board and on the committees on which she serves. |

Mr. Robertson has served on the Board since June 2016. He is currently a corporate director. From 2013 through August 2016, Mr. Robertson served as Executive Vice President and Head, Anti-Money Laundering, at BMO Financial Group (“BMO”), a diversified financial services organization. Prior to that role, he served as Executive Vice President, Business Integration, at BMO Financial Group, and as Vice Chair at BMO Financial Corp. from 2011. He joined BMO as interim Chief Financial Officer, BMO Financial Group in 2008 and was appointed Chief Financial Officer, BMO Financial Group in 2009. Before joining BMO, Mr. Robertson spent over 35 years as a Chartered Public Accountant. In this capacity, he held various senior positions with a number of major accounting firms, including Vice Chair, Deloitte & Touche LLP in Toronto, Canada, from 2002 to 2008, and Canadian Managing Partner, Arthur Andersen LLP, from 1994 to 2002. Mr. Robertson holds a Bachelor of Arts degree (Honours) from the Ivey School of Business at the University of Western Ontario.

Mr. Robertson has served on the board of Hydro One Limited, a publicly traded electricity transmission and distribution utility serving the Canadian province of Ontario, since August 2018, and since 2012 has served on the board of Turquoise Hill Resources, a publicly traded Canadian mineral exploration and development company. Mr. Robertson previously served on the board of Virtus Investment Partners, Inc., a multi-manager asset management business, from 2013 to August 2016.

Director Qualifications:

The Board has determined that Mr. Robertson’s extensive experience of complex financial matters at Deloitte & Touche LLP and Arthur Andersen LLP, in-depth knowledge of financial and accounting matters and leadership capabilities in senior finance positions qualify him to serve as a member of the Board and as Chairman of the Audit and Risk Committee.

22

Russel C. Robertson

Ontario, Canada

Age 73

Independent

Stock Ownership:

113,704 RSUs (comprised of 102,667 vested RSUs — $3,259,677, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $3,259,677, representing 652% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 3,260% of the annual Board retainer.

2020 Meeting Attendance:

Audit and Risk Committee — 9/9

Nominating and Corporate Governance Committee — 3/4

Mr. Ross has served on the Board since March 2016 and was appointed our Lead Independent Director in June 2016. He has served as the President of Volcker Alliance since July 2016, where he also serves as a director. He is President Emeritus of the University of North Carolina (“UNC”), having served as President from 2011 to January 2016. Mr. Ross was named the Sanford Distinguished Fellow in Public Policy at the Duke University Sanford School of Public Policy in 2016 and continues to serve in that role. Prior to becoming President of the UNC system, Mr. Ross served as President of Davidson College, Executive Director of the Z. Smith Reynolds Foundation, director of the North Carolina Administrative Office of the Courts, a Superior Court judge, chief of staff to U.S. Congressman Robin Britt, a member of the Greensboro, NC law firm Smith, Patterson, Follin, Curtis, James & Harkavy, and Assistant Professor of Public Law and Government at UNC Chapel Hill’s School of Government. Mr. Ross holds a B.A. in Political Science from Davidson College and a J.D. from University of North Carolina School of Law.

Director Qualifications:

The Board has determined that Mr. Ross’s demonstrated leadership in senior management positions, extensive experience with corporate governance responsibilities and complex knowledge of legal, compliance and operational issues qualify him to serve as a member of the Board and the committees on which he serves.

Thomas W. Ross, Sr.

North Carolina, USA

Age 70

Independent

Stock Ownership:

11,500 Common Shares — $365,125

78,779 RSUs (comprised of 67,742 vested RSUs — $2,150,809, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $2,515,934, representing 503% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 2,516% of the annual Board retainer.

2020 Meeting Attendance:

Audit and Risk Committee — 9/9

Nominating and Corporate Governance Committee — 4/4

Special Transactions Committee — 4/4

TABLE OF CONTENTS

Dr. von Eschenbach has served on the Board since October 2018. Dr. von Eschenbach has been the President of Samaritan Health Initiatives, Inc., a health care policy consultancy, and an Adjunct Professor at University of Texas MD Anderson Cancer Center, since 2010. From 2005 to 2009, Dr. von Eschenbach served as Commissioner of the U.S. Food and Drug Administration (the “FDA”). He was appointed Commissioner of the FDA after serving for four years as Director of the National Cancer Institute at the National Institutes of Health. As a researcher, clinician and administrator, Dr. von Eschenbach served for twenty-six years at the University of Texas MD Anderson Cancer Center as Chairman of Urology, Director of the Prostate Cancer Research Program and Executive Vice President and Chief Academic Officer. He earned a B.S. from St. Joseph’s University and a medical degree from Georgetown University School of Medicine in Washington, D.C. He completed his residency in surgery and urology at Pennsylvania Hospital and University of Pennsylvania, respectively, and his urologic oncology fellowship at University of Texas MD Anderson Cancer Center.

Dr. von Eschenbach has served as a director of Radius Health, Inc., a publicly traded biopharmaceutical company, since January 2021. He has served as a director of Celularity, Inc., a private biotechnology company, and as a director of Wren Therapeutics, Ltd, a private biopharmaceutical company, since February 2018 and November 2019, respectively. Dr. von Eschenbach also been a member of the board of the Regan Udall Foundation of the FDA, a non-profit organization formed to advance regulatory science, since December 2018.

Director Qualifications:

The Board has determined that Dr. von Eschenbach’s broad experience serving as a director of public and private companies and non-profit organizations in the pharmaceutical and healthcare industries, as well as serving as an advisor and consultant to entities engaged in policy development in the pharmaceutical industry, qualify him to serve as a member of the Board and the committee on which he serves.

Andrew C. von Eschenbach, M.D.

Texas, USA

Age 79

Independent

Stock Ownership:

2,100 Common Shares — $66,675

27,502 RSUs (comprised of 16,465 vested RSUs — $522,764, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $589,439, representing 118% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 589% of the annual Board retainer.

2020 Meeting Attendance:

Science and Technology Committee — 6/6

Dr. Wechsler has served on the Board since June 2016. She has been a practicing dermatologist in New York City since 2005. Dr. Wechsler is the author of The Mind-Beauty Connection, published by Simon & Schuster in 2008. She is board certified in both dermatology and psychiatry and is also an Adjunct Clinical Professor in Psychiatry at the Weill Cornell Medical College. As an expert on skin health, Dr. Wechsler serves as an advisor for Chanel Skin Care and is also a certified trainer and well-known KOL Speaker, qualified to teach physicians and other medical professionals in the use of various dermatological products. Dr. Wechsler is an active member of several medical professional organizations, including the American Academy of Dermatology, the American Psychiatric Association, the American Academy of Child and Adolescent Psychiatry, the Independent Doctors of New York, The Physicians Scientific Society, and The Skin Cancer Foundation. Dr. Wechsler completed her residency in psychiatry and a fellowship in child and adolescent psychiatry at New York Presbyterian Hospital’s Payne Whitney Clinic, and completed a residency in dermatology at SUNY Downstate Medical Center.

Director Qualifications:

The Board has determined that Dr. Wechsler’s many years of experience as a board-certified dermatologist and psychiatrist, her strong knowledge of medical products to assist patients with their medical needs and her insight into the medical field and pharmaceutical industry and healthcare related issues qualify her to serve as a member of the Board and on the committees on which she serves.

Amy B. Wechsler, M.D.

New York, USA

Age 51

Independent

Stock Ownership:

101,501 RSUs (comprised of 90,464 vested RSUs — $2,872,232, and 11,037 unvested RSUs — $350,425)

Total Equity Value at Risk: $2,872,232, representing 574% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee Directors and 2,872% of the annual Board retainer.

2020 Meeting Attendance:

Talent and Compensation Committee — 5/7

Science and Technology Committee — 6/6

Messrs. Icahn and Miller were appointed to the Board on March 17, 2021 pursuant to the Nomination Agreement described under “Certain Transactions” beginning on page 90. No other directors or director nominees of the Company were selected for nomination at the Annual Meeting pursuant to any arrangement or understanding. None of the directors or director nominees are related by blood, marriage or adoption to one another or to any executive officer of the Company.

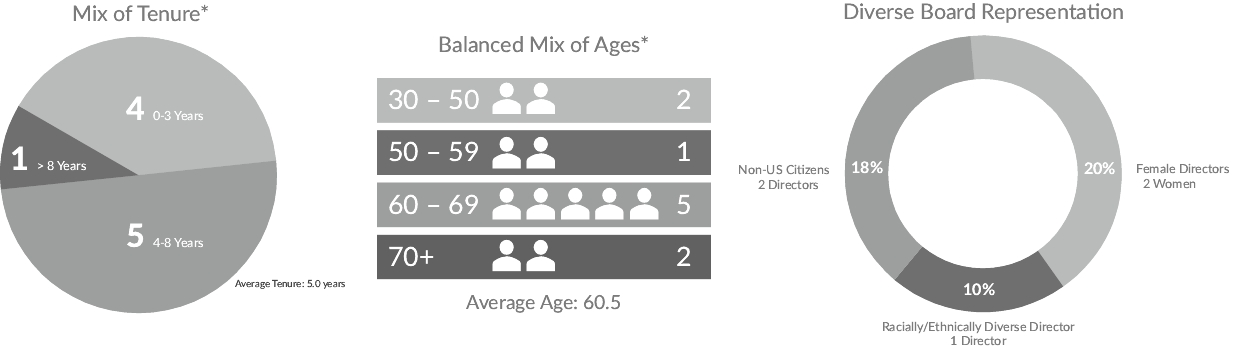

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Board is committed to sound and effective corporate governance practices with the goal of ensuring the Company’s financial strength and overall business success. Our governance practices are periodically assessed against those practices suggested by recognized governance authorities and are designed to maintain alignment with shareholder interests and key governance best practices.

The Board believes that, in order to be effective, our Board must be able to operate independently of management. As described in our Corporate Governance Guidelines, available on our website at

www.bauschhealth.com (under the tab “Investors” and under the subtab “Corporate Governance — Corporate Governance Documents”), a sufficient number of directors must satisfy the applicable tests of independence, such that the Board complies with all independence requirements under corporate and securities laws and stock exchange requirements applicable to the Company. The Corporate Governance Guidelines further provide that the Nominating and Corporate Governance Committee, as well as the Board, reviews the relationships that each director has with the Company in order to satisfy itself that these independence criteria have been met. On an annual basis, as part of our disclosure procedures, all directors complete a questionnaire pertaining to, among other things, share ownership, family and business relationships, and director independence standards. The Board must then disclose in the Company’s annual management proxy circular and proxy statement the identity of each of the independent directors and the basis for the Board’s determination for each of the directors who are not independent.

The

As of the date of the Meeting, the Board

is currentlywill be comprised of

thirteenten members. The Board has determined that

twelvenine of our

thirteenten current directors (or

92%90%) are “independent directors” within the meaning of applicable regulatory and stock exchange requirements in Canada and the United States, as none of them have a material relationship with the Company that could be reasonably expected to interfere with their exercise of independent judgment. The

twelvenine independent directors currently on the board are: Mr.

Ross (Lead Independent Director), Mr. De Schutter, Mr. Hale, Mr. Icahn,

Dr. Karabelas, Ms. Kavanagh, Mr. Miller,

Dr. Mulligan, Mr. Paulson, Mr. Power, Mr.

Ross, Mr. Robertson,

Dr. von Eschenbach, and Dr. Wechsler.

None of our current directors (all of whom are director nominees) have entered into employment, service or similar contracts with us, with the exception of Mr.

Papa. On April 25, 2016, Mr. Papa entered into an employment agreementAppio, as further discussed in the section titled “Compensation Discussion and Analysis – Arrangements with

the Company as its Chairman of the Board and Chief Executive Officer (“CEO”)Our NEOs” on page 53. For this reason, the Board has determined that

heMr. Appio is not an independent director and will not be eligible to serve on the Audit and Risk Committee, the Talent and Compensation Committee, or the Nominating and Corporate Governance Committee.

Board Leadership Structure

Our Corporate Governance Guidelines provide

In connection with the resignation of Mr. Papa as CEO and director, the Board appointed Mr. Paulson as the Non-Executive Chairperson of the Board. With Mr. Paulson serving as the Non-Executive Chairperson of the Board, there was no need for a Lead Independent Director and Mr. Ross resigned that ourposition, but remained a director. With the roles of Chairperson and CEO separated, the Board may determine from timedetermined to timehave the most effective leadership structure forChairperson in a presiding capacity, coordinating the Company, including whether the same individual should serve both as Chairmanactivities of the Board and perform the CEO. Mr. Papa, our CEO, also serves as Chairman of the Board. Due to the in-depth knowledge of the Company’s operations gained by serving as CEO, Mr. Papa is well positioned to identify and lead Board deliberations regarding important matters relating to the Company’s operations, strategic priorities, and overall development. The Board believes that serving as both CEO and Chairman of the Board enables Mr. Papa to facilitate effective communication between Company management and the Board and to

ensure key issues and recommendations are brought to the attention of the Board. The Board believes that this leadership structure, in conjunction with the appointment of a Lead Independent Director, is the most effective for the Company at this time, and that the existing corporate governance practices effectively achieve independent oversight and management accountability.

Our Corporate Governance Guidelines also provide that, if the same individual serves as Chairman of the Board and CEO, or if the Chairman of the Board is otherwise not independent, our Board shall appoint a Lead Independent Director. Our independent directors annually appoint a Lead Independent Director. Mr. Ross has been appointed to serve as Lead Independent Director each year since June 2016.

The responsibilities of the Lead Independent Director areduties set forth in the Company’s Position Description for the Lead Independent Director,Chairperson of the Board, which is posted on the Company’s website at www.bauschhealth.com (under the tab “Investors” and under the subtab “Corporate Governance — Corporate Governance Documents”). These responsibilities include: (i) fostering processes that allowleading, managing and organizing the Board to function independently of management and encouraging open and effective communication between the Board and management of the Company; (ii) providing input to the Chairman on behalf of the independent directors with respect to Board agendas; (iii) presiding at all meetings of the Board at which the Chairman is not present, as well as regularly scheduled executive sessions of independent directors; (iv) in the case of a conflict of interest involving a director, if appropriate, asking the conflicted director to leave the room during discussion concerning such matter and, if appropriate, asking such director to recuse him or herself from voting on the relevant matter; (v) communicatingconsistent with the Chairman and the CEO, as appropriate, regarding meetings of the independent directors and resources and information necessary for the Boardapproach to effectively carry out its duties and responsibilities; (vi) serving as liaison between the Chairman and the independent directors; (vii) being available to directors who have concerns that cannot be addressed through the Chairman; (viii) calling meetings of the independent directors, as needed or when appropriate; and (ix) performing other functions as may reasonably be requestedcorporate governance adopted by the Board from time to time; (ii) guiding the Board’s deliberations so that appropriate strategic and policy decisions are made; (iii) promoting cohesiveness among the Directors; (iv) satisfying himself or the Chairman. In the event the Company appoints an independent Chairman of the Board,herself that the responsibilities of the Lead Independent Director will be assumedBoard and its committees are well understood by the independent Chairman ofDirectors; and (v) acting as spokesperson for the Board.

Meetings of Independent Directors

The Corporate Governance Guidelines provide that the independent directors of the Board may meet in executive session at any meeting of the Board, and that an opportunity shall be provided during the meeting for any member of the Board to make such a request. The independent directors generally meet in executive sessions without management present during their regularly scheduled board and committee meetings, and on an as-needed basis during ad hoc meetings. Mr. Ross,Paulson, our Lead Independent Director,Chairperson of the Board, presides over executive sessions of the Board, and the committee chairs, all of whom are independent, preside over executive sessions of the Committees. During 2020,2023, our independent directors held executive sessions at each of the four regularly scheduled Board meetings and at one ad hoc meeting.meetings.

TABLE OF CONTENTS

The Board meets regularly, at least four times per year, including at least once annually to review our strategic plan. Additional meetings can be called when necessary. From January 1,

20202022 to December 31,

2020,2022, the Board had four regularly scheduled meetings and

fivenine ad hoc meetings to review specific matters. All agendas for Board and Board committee meetings are set by the

ChairmanChairperson of the Board in consultation with the Board committee Chairpersons, as necessary.

As required by the Company’s Articles, at least 50% of the directors then in office must be present in order to transact business at any Board meeting.

AtAll incumbent directors attended at least

91% of our directors participated in each94% of the

total Board

and Committee meetings

held during 2020.on which he or she served in 2022.

During 2020,2022, the Board had fivesix standing committees: the Audit and Risk Committee, the Talent and Compensation Committee, the Nominating and Corporate Governance Committee, the Finance and Transactions

Committee, and the Science and Technology Committee. In addition, on June 3, 2020, the Board established an ad hocCommittee, and Special Transactions Committee, to assist with evaluating strategic alternatives, including the proposed separation of the Company’s eye health business into an independent, publicly traded entity.

which was dissolved on October 25, 2022.

Directors are expected to attend and participate in substantially all meetings of the Board and of all committees on which they serve. The Board and Board committee attendance records for all directors who served on the Board during

20202022 are set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Board

9 Meetings | | | Audit

and Risk

Committee

9 Meetings | | | Talent and

Compensation

Committee

7 Meetings | | | Nominating

and

Corporate

Governance

Committee

4 Meetings | | | Finance and

Transactions

Committee

7 Meetings | | | Science and

Technology

Committee

6 Meetings | | | Special

Transactions

Committee

4 Meetings | | | Overall | |

Director | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | |

Richard U. De Schutter | | | 9 | | | | 100 | % | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | 27/27 | | | | 100 | % |

D. Robert Hale | | | 9 | | | | 100 | % | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | 27/27 | | | | 100 | % |

Dr. Argeris (Jerry) N. Karabelas | | | 9 | | | | 100 | % | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | — | | | | — | | | | 6 | | | | 100 | % | | | 4 | | | | 100 | % | | | 26/26 | | | | 100 | % |

Sarah B. Kavanagh | | | 8 | | | | 89 | % | | | 9 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | 7 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | 32/33 | | | | 97 | % |

Joseph C. Papa | | | 9 | | | | 100 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 9/9 | | | | 100 | % |

John A. Paulson | | | 9 | | | | 100 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 7 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | 20/20 | | | | 100 | % |

Robert N. Power | | | 9 | | | | 100 | % | | | 9 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | — | | | | — | | | | 6 | | | | 100 | % | | | — | | | | — | | | | 28/28 | | | | 100 | % |

Russel C. Robertson | | | 8 | | | | 89 | % | | | 9 | | | | 100 | % | | | — | | | | — | | | | 3 | | | | 75 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 20/22 | | | | 91 | % |

Thomas W. Ross, Sr. | | | 9 | | | | 100 | % | | | 9 | | | | 100 | % | | | — | | | | — | | | | 4 | | | | 100 | % | | | — | | | | — | | | | — | | | | — | | | | 4 | | | | 100 | % | | | 26/26 | | | | 100 | % |

Andrew C. von Eschenbach, M.D. | | | 9 | | | | 100 | % | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 6 | | | | 100 | % | | | — | | | | — | | | | 15/15 | | | | 100 | % |

Amy B. Wechsler, M.D. | | | 8 | | | | 89 | % | | | — | | | | — | | | | 5 | | | | 71 | % | | | — | | | | — | | | | — | | | | — | | | | 6 | | | | 100 | % | | | — | | | | — | | | | 19/22 | | | | 86 | % |

| | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % | | | # | | | % |

Thomas J. Appio(1) | | | 12 | | | 100% | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Richard U. De Schutter | | | 12 | | | 100% | | | — | | | — | | | 8 | | | 100% | | | — | | | — | | | 12 | | | 92% | | | — | | | — | | | 2 | | | 100% | | | 34 | | | 94% |

Brett M. Icahn | | | 13 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | 13 | | | 100% | | | — | | | — | | | 2 | | | 100% | | | 28 | | | 100% |

Dr. Argeris N. Karabelas | | | 13 | | | 100% | | | — | | | — | | | 8 | | | 100% | | | — | | | — | | | — | | | — | | | 3 | | | 100% | | | 2 | | | 100% | | | 26 | | | 100% |

Sarah B. Kavanagh | | | 13 | | | 100% | | | 8 | | | 100% | | | — | | | — | | | 6 | | | 100% | | | 13 | | | 100% | | | — | | | — | | | 2 | | | 100% | | | 42 | | | 100% |

Steven D. Miller | | | 13 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | 13 | | | 100% | | | — | | | — | | | 2 | | | 100% | | | 28 | | | 100% |

Dr. Richard C. Mulligan(1) | | | 9 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2 | | | 100% | | | — | | | — | | | 11 | | | 100% |

Joseph C. Papa(3) | | | 7 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 7 | | | 100% |

John A. Paulson(1)(3) | | | 11 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | 2 | | | 100% | | | — | | | — | | | 2 | | | 100% | | | 15 | | | 100% |

Robert N. Power(2) | | | 13 | | | 100% | | | 8 | | | 100% | | | 4 | | | 100% | | | 6 | | | 100% | | | — | | | — | | | 1 | | | 100% | | | — | | | — | | | 32 | | | 100% |

Russel C. Robertson | | | 13 | | | 100% | | | 8 | | | 100% | | | — | | | — | | | 6 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | 27 | | | 100% |

Thomas W. Ross, Sr. | | | 13 | | | 100% | | | 8 | | | 100% | | | — | | | — | | | 6 | | | 100% | | | — | | | — | | | — | | | — | | | 2 | | | 100% | | | 29 | | | 100% |

Andrew C. von Eschenbach(1) | | | 4 | | | 100% | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1 | | | 100% | | | — | | | — | | | 5 | | | 100% |

Amy B. Wechsler, M.D. | | | 13 | | | 100% | | | — | | | — | | | 8 | | | 100% | | | — | | | — | | | — | | | — | | | 3 | | | 100% | | | — | | | — | | | 24 | | | 100% |

(1)

| On the IPO Closing Date, Mr. Appio and Dr. Mulligan joined the Board and Dr. von Eschenbach and Mr. Paulson resigned from the Board. Dr. Mulligan joined the Science & Technology Committee. |

(2)

| On the IPO Closing, Mr. Power resigned from the Science & Technology Committee and joined the Talent & Compensation Committee. |

(3)

| On June 23, 2022, Mr. Papa resigned from the Board and Mr. Paulson rejoined the Board as the Non-Executive Chairperson. |

(4)

| On October 25, 2022, the Board dissolved the Special Transactions Committee. |

Although we do not have a formal policy requiring our directors to attend our Annual Meetings of Shareholders, we expect all directors to attend the Annual Meeting absent exceptional circumstances. The 20202022 Annual Meeting of Shareholders was attended by all directors who were serving on the Board at that time and we anticipate that our directors will attend this year’s virtual Annual Meeting.

TABLE OF CONTENTS

The Board is responsible for the overall stewardship of the Company and its business, including supervising the management of the Company’s business and affairs. The Board discharges this responsibility directly and through delegation of specific responsibilities to committees of the Board and to our officers. Under the charter of the Board (the “Board Charter”), the Board has established committees to assist with its responsibilities. Our current standing Board committees are: the Audit and Risk Committee, the Talent and Compensation Committee, the Nominating and Corporate Governance Committee, the Finance and Transactions Committee, and the Science and Technology Committee.

The Board has also established an ad hoc Special Transactions Committee to assist with evaluating strategic alternatives, including the proposed separation of the Company’s eye health business into an independent, publicly traded entity.Under the Board Charter, the Board is responsible for, among other things, the following corporate governance-related matters: (i) overseeing the Company’s performance and the quality, depth and continuity of management needed to meet the Company’s strategic objectives; (ii) developing and approving the Company’s approach to and practices regarding corporate governance; (iii) succession planning; (iv) overseeing orientation and education programs for new directors and ongoing education opportunities for continuing directors; (v) reviewing, discussing and approving the Company’s strategic planning and organizational structure and supervising management to oversee that the strategic planning and organizational structure preserve and enhance the business of the Company and the Company’s underlying value; (vi) approving and assessing compliance with all significant policies and procedures by which the Company is operating, including the Company’s Standards

Bausch Health Code of Business Conduct (as described below); (vii) reviewing the Company’s principal risks and assessing whether appropriate systems are in place to manage such risks; and (viii) ensuring the integrity and adequacy of the Company’s internal controls.

The Board Charter is attached to this Proxy Statement as Exhibit A and is available on our website at

www.bauschhealth.com (under the tab “Investors” and under the subtab “Corporate Governance – Corporate Governance Documents”).

The Board has developed written position descriptions for the

ChairmanChairperson of the Board, the CEO,

the Lead Independent Director, and the Chairpersons of each of the Audit and Risk Committee, the Nominating and Corporate Governance Committee, the Talent and Compensation Committee, the Finance and Transactions Committee, and the Science and Technology Committee. The position descriptions are reviewed annually and are posted on our website at

www.bauschhealth.com (under the tab “Investors” and under the subtab “Corporate Governance — Corporate Governance Documents”).

Orientation and Continuing Education